The price of reform: the people's budget and the present trauma

Historian article

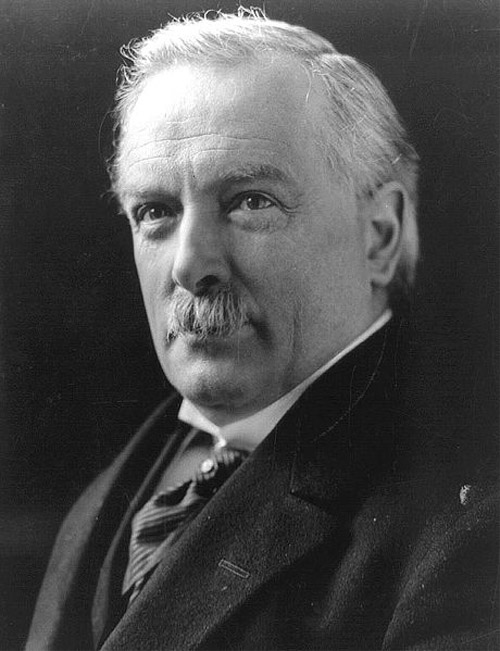

When Lloyd George succeeded Asquith as Chancellor of the Exchequer in April 1908, his first task was to introduce the old age pensions Asquith had initiated. His second was to prove even more momentous. On 29 April 1909 he presented what has become known as "The People's Budget".

The task facing the Liberal Government was to raise £16m more revenue (rather more than it sounds, given the gap was one-tenth of the Budget then and the equivalent in cash terms of more than £900m now), primarily to meet the pension costs that were unfunded after a downturn in trade and to build additional warships (Dreadnoughts) for the navy. The main options were to tax wages or wealth. As a radical Chancellor in a reforming Liberal government, Lloyd George took the latter course. Although the measures included increased taxes on alcohol and tobacco, and introduced those on fuel and the motor fund, levies on consumption accounted for far less than the main proposals of a super-tax for incomes of £5000 or more - about £280,000 today - and particularly a range of land taxes. The wealthy and those whose income was unearned were targeted rather than introducing general increases in income tax...

This resource is FREE for Student HA Members.

Non HA Members can get instant access for £2.75